5 Lessons learned by getting debt free in 2023

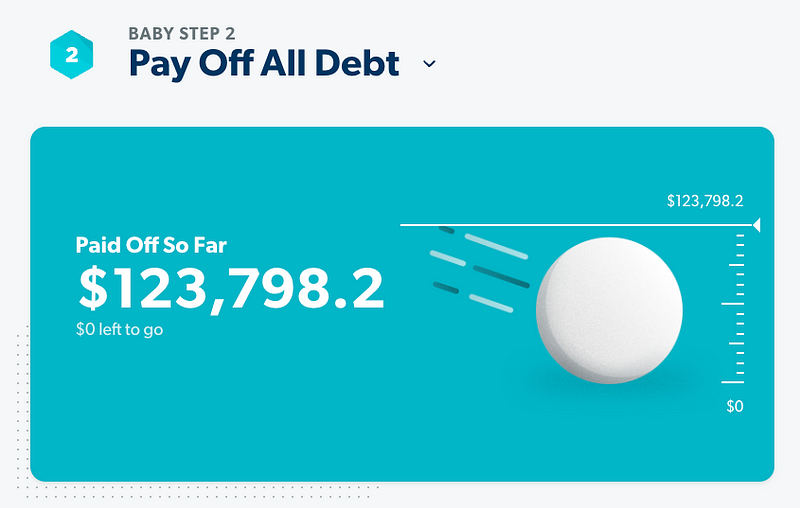

My husband and I paid off our last consumer debt in February of 2023. We have our mortgage still, but otherwise we have no other debt to our names. Together, we paid off almost $128,000 in 5 years, while cash flowing two pregnancies (I didn’t have insurance), a car and two college degrees (one still in progress). We learned a lot through this process and I want to share the 5 things that helped us the most as we worked toward this massive goal.

A little background

Everyone’s finances look different, so I want to give some context to our journey.

Debt

- Capital One Credit Cards: $4,472

- USAA Credit Card: $11,468

- Target Credit Card: $500

- Jeep Loan: $7,964

- Air Conditioning Loan: $12,850

- Husband’s Car: $35,225

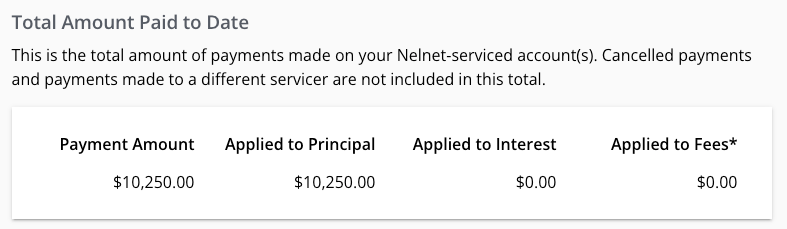

- Husband’s Student Loans: $10,250

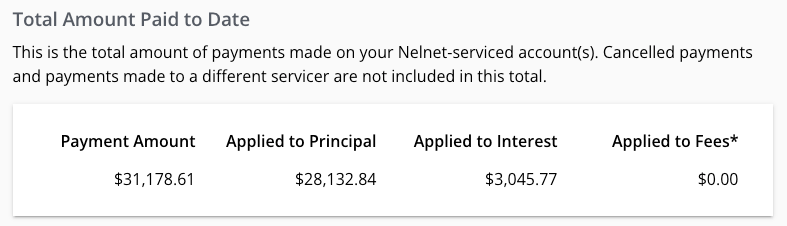

- My Student Loans: $31,179

- Other Credit Cards: $13,241

Income

When we started this journey in late 2017 we were making around $50,000 per year combined. Shortly after that, my husband left the military as a disabled veteran and was unemployed for 6 months so we dropped down to around $24,000.

Over the years our income ranged from $24,000 — $65,000. It wasn’t until my husband got a new job in Jan 2023, that we ever made over $65,000. Most of our journey was done on LESS than the average household income for Colorado.

After job changes, schooling and lots of side hustles, we are on track to make around $120,000 this year. I am currently working part time while in school so that number will likely double by 2025 if all goes to plan!!

Husband Salary — $72,000

Husband Disability Payments — $27,000

My Contract Work — $21,000

Situations

During our debt payoff journey we had two kids, both pregnancies were cash-flowed and we used CHM to help cover the bulk of the expenses. Our truck was totaled and we had to get a different car, which we got a small loan for and paid off in 5 months. We bought our first home, then sold it. We purchased my parents home, then renovated it. My husband completed a bachelors and masters program, and I’m actively finishing my bachelor’s degree — also cash flowed.

Proof

So many people will tell you this isn’t possible, but it is. I have screenshots of all our debt payoffs as proof. We did this with below-average incomes, while going to school and while raising kids. It’s possible!

Lesson 1: Budgeting is the best tool

Budgeting was our secret weapon on this debt-free journey. We didn’t go full-on cash envelopes or cancel every automatic payment, but we did something equally powerful — we planned our finances meticulously and stuck to that plan like glue. It took us about six months to fine-tune our budget and find the perfect system, but once we did, there was no turning back. Budgeting gave us the clarity and control we needed to tackle our debt head-on.

Over the years we used a few different budgeting apps; EveryDollar, YNAB and now we’re using a google spreadsheet — the method stayed the same though. We practiced the snowball method of debt payoff (smallest amount to the highest, not looking at interest) and we did a zero-based budget (every single dollar was accounted for).

Lesson 2: You have to work more

Paying off a significant amount of debt while dealing with life’s curveballs requires more than just careful budgeting. We knew we had to increase our income. I picked up extra contract work, and my husband went back to school to explore new job opportunities. It wasn’t easy, and it meant sacrificing a lot of our free time, but it was a crucial step towards our financial freedom. Sometimes, working a little extra is the key to making those debt payments more manageable.

On top of this, we had to find jobs that would allow us to be home for our infants. We didn’t want to add daycare as another expense, so for a long time, my kids came to work with me. We worked remote jobs, opposite schedules and at time my husband was a stay-at-home dad to keep expenses as low as possible. It was a constant struggle to make these schedules work, but we got more time with our babies and still hit our goals.

Lesson 3: Sacrifice now

Getting debt-free isn’t always about living the high life. We had to make some sacrifices along the way. While our friends might have been indulging in dinners out and vacations, we were focused on our goal. We chose to delay gratification and prioritize our financial future. It meant saying no to some immediate pleasures, but the peace of mind we gained was worth every sacrifice.

We lived with our sisters to lower rent costs, we cancelled Netflix and amazon prime, we stopped eating out and getting coffee. We thrifted more than every before and cut coupons for the grocery stores. We had cars that were not our top choices, we worked jobs that we didn’t love. All of it was for a short time and it was well worth the peace we have now.

Lesson 4: Stop listening to advice

Throughout our journey, we received a lot of well-intentioned advice, some of which didn’t align with our goals. We learned to filter out the noise and trust our own judgment. What worked for someone else might not work for you. It’s important to recognize that personal finance is, well, personal. Don’t be afraid to blaze your own trail and make decisions based on what’s right for your unique situation.

I can’t count how many times we were advised NOT to pay off our student loans — either because forgiveness would happen or we were better off investing that money. But I can tell you after 8 months of being debt free, there is no better feeling that not having payments due every month to someone else. Most of our income goes straight into savings and investments now, and we are investing WAY more than we would have been able to if we just kept making payments.

The best thing to do is to only take advice from people who are where you want to be. If you want to be debt free, listen to debt free people. If you want to be a great investor, listen to great investors. If you want to own rental properties and leverage your debt, listen to people doing that. While I have my own idea of what successful finances look like, you might not agree. Find people to mentor you that you trust and block out the rest of the noise.

Lesson 5: Get a community around you

Lastly, having a supportive community can make a world of difference. Whether it’s friends who understand your financial goals or online forums and resources, having people who share your journey can provide motivation, encouragement, and valuable insights. Connecting with others who are on a similar path can help you stay on track and remind you that you’re not alone.

While our family was supportive, they didn’t fully understand WHY we were doing all of this. We relied on online communities, listening to podcasts and other people on the same debt-free journey as us to keep motivated.

Everyone’s financial situation is unique, but these principles can be adapted to fit your circumstances. Getting debt-free is challenging, but with determination, smart planning, and a supportive community, it’s absolutely achievable. Anyone who tells you it’s not is not telling you the truth. It’s hard, but it’s worth it. Keep at it.

👏🏼 If you found this article valuable hit those clapping hands once or twice.

💻 If you want to support my work and thousands of others, consider signing up for Medium. (If you sign up using my link, I earn a small commission.)

✨ Thank you for reading & for your support!